I was recently interviewed by a European business magazine on the outlook for oil prices and the global gas market, which I thought I could usefully turn into a blog this week.

What’s happening in the oil market, production was first cut and now it’s been increased again. How much of this is about politics?

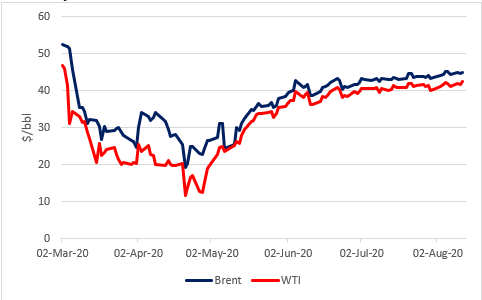

When OPEC (meaning OPEC+Russia and ten other non-OPEC countries) announced their production cuts back in April, oil demand was in freefall because of Covid (an estimated decline of 20-30mbd in 2Q) and the Saudi Arabia-Russia price war which started in March was just making matters worse. An agreement between as many producers as possible was essential to stabilise markets and that was achieved when Saudi Arabia, Russia and the US all reached agreement to reduce oil production and a series of other producers also agreed to cut output. In mid-April Brent crude oil bottomed at below $10/bbl but since then it has been steadily rising because (a) the agreement immediately took 9.7 mbd of supply off the market, (b) there was a path to rising production over time for oil producing countries as the cuts eased (and the August 1 increase in output was part of that process) which meant there was light at the end of the tunnel for the countries cutting output and (c) compliance, which is usually a problem, was reasonably good at 108% for June although there is evidence of some slippage in July. Brent recovered to above $40/bbl which is where it is today. A dollar or two price change is very minor compared to the $60/bbl fall we saw from January to April so we can certainly say that the OPEC+ Agreement has been a success so far.

Oil prices March to date

In your opinion, when will oil prices stabilize on the world market? What are your expectations and forecasts? What events are likely to have a positive impact on the stabilization of oil prices?

I think we can say that oil prices have already stabilised, since for the last two months Brent has been around $40-45/bbl. It’s very hard to predict with any certainty in which direction it’s likely to move from here. Oil demand is recovering, particularly in economies struck by the pandemic early on – such as China. Government stimulus packages in the US, Europe and elsewhere have had a positive impact on demand. Output cuts by major producers have seen high levels of compliance as I mentioned earlier (because the consequences of non-compliance were very obvious to everyone in March/April).

What could go wrong and drive prices lower again? First, a serious resurgence of the pandemic requiring lockdowns in major economies. That would choke off recovering demand and lead to price falls. Second, compliance by producers could weaken – higher output would send prices lower. On the other side of the equation, a vaccine or clearly more effective therapeutic drugs would encourage economic activity and help companies plan for a future of growth which would be positive for oil prices.

US analysts are sounding the alarm that all large-scale plans for the supply of American liquefied natural gas to Europe are under threat. The concern is that low demand and gas prices in both Europe and Asia make the economics of supplying liquefied natural gas from the United States unattractive. Buyers of this gas have already refused 110 cargoes of LNG supplies in the summer. This downbeat analysis comes from the US Energy Information Administration. In the summer of 2020, more than 70 US LNG export shipments were cancelled in June and July, and more than 40 for August. What are your thoughts on this and how do you see the prospects of an American LNG exports to Europe?

I think their concern is justified. The economics of the trans-Atlantic trade rely on the price differential between Henry Hub in the US and locations such as the UK’s National Balancing Point (NBP) or The Netherlands Title Transfer Facility (TTF). Over the course of 2020 the differential between the US and European hub prices has steadily increased and it remains unprofitable to ship US LNG to Europe after taking account of the fact that Henry Hub prices FOB the US are $1.76/mmBtu while shipping, fees and liquefaction add $4.50/mmBtu to the cost, making US LNG delivered to Europe $6.26/mmBtu against a spot price of gas in the UK of $1.53/mmBtu. So, the trade is clearly unprofitable and it’s not surprising that European buyers have rejected so many US cargoes.

Looking forward I don’t see this situation changing until European LNG demand picks up and that depends on economic recovery in Europe but also on how Russia’s Gazprom behaves in the market since it wants to increase its own pipeline sales and it competes against some demand which would otherwise be met by LNG. US gas storage is at high levels so even if temperatures rise and air-conditioning demand goes up, that’s unlikely to help the finances of US gas producers and we should expect some shut-ins over the next few months. That might lead to higher prices towards the end of the year, although it’s the differential between US and European gas prices that is critical for trade to resume and it will probably remain too low to pay for the shipping costs.

A large number of LNG liquefaction plants have been built in the US as part of the country’s plans to export LNG. How do you see the prospects for Russian LNG in this regard? The trade war between China and the United States has also affected the gas sector – is Russia going to be a beneficiary of this competition?

There are now many LNG suppliers in the world – such as the US, Russia, Qatar, Australia and Nigeria. The US will be a competitor to Russia in seeking LNG buyers around the world – and not just LNG buyers, Russia has a very large pipeline gas export industry which also competes in the global gas market. Europe is one of the obvious battlegrounds – it’s a very large market, Russia supplies almost a third of its pipeline gas imports but is also able to supply LNG to Europe. Here, everything depends on the price of gas and the long-term contracts that have been agreed.

China is another market which imports a lot of LNG but also has pipeline connections to a range of countries (Turkmenistan, Kazakhstan and Uzbekistan in Central Asia, Myanmar and, most recently, Russia through the Power of Siberia line which started deliveries last year). In the past, Chinese LNG purchases have mainly come from Australia, Qatar and Malaysia. Russia has been delivering LNG from Sakhalin 2 while the US is a more recent supplier to China. However, the imposition of tariffs by China on US LNG imports in 2018 and 2019 means that US LNG is now uncompetitive against the other options available to China. There is definitely some benefit to Russia as a result of these tariffs, although the US volumes being replaced are relatively small and other producers – such as Australia and Qatar – will also be looking to deliver LNG to China so the scope to raise prices is limited given the competitive market.

Qatar, Australia, Russia and the US have ambitious plans to increase their exports of LNG. Is there a threat of the market being oversupplied with gas?

There is certainly the risk of an oversupply of LNG from the various projects in development, although the industry moves in cycles. Not long ago, with low prices, there was concern that not enough LNG export capacity was being built and that prices would rise sharply in the future. With the impact of Covid-19, there are now concerns that with much lower demand forecast (a drop of 4% this year for example), there may be too many LNG export projects and the market could be oversupplied. If we add to that the continuing push for renewables, there is the potential for an oversupplied gas market globally.

Deliveries of Russian LNG to China in June 2020 exceeded volumes from the US. In June, Russia delivered 396 kt of LNG to China, Bloomberg reports. That’s six times more than last year. The agency notes that Russian supplies have exceeded American ones which were 340 kt. How do you see the prospects for Russian-Chinese cooperation in the LNG sector?

I think China’s LNG demand will certainly grow in the future. But so will demand for pipeline gas, oil, coal, nuclear and renewables. China is a very large economy and continues to grow at quite high rates, requiring large amounts of energy. It would be unrealistic to believe that any one source of energy could meet all that demand so I’m sure that China will maintain a diversified portfolio of energy – especially in imported energy, which has become a growing concern in the last year as relations with the US have deteriorated. In natural gas, China is likely to prefer pipeline gas from neighbouring countries over seaborne LNG and when it does buy LNG it will want to ensure that it has a range of gas suppliers. This is a positive for Russia-China relations. The Power of Siberia pipeline has capacity of 38 bcma and a number of additional pipelines further west are also being discussed with capacity of between 25-50 bcma. Increased LNG exports from Russia to China are also possible from the fields offshore Russia’s Pacific coast. Yamal LNG may also make its way to China, given that both CNPC and CNOOC have stakes in the Novatek project.

In which markets is there competition between pipeline gas and LNG? What is the outlook for the development of this competition?

Two obvious markets where there is competition between LNG and pipeline gas are Europe and China as I discuss above, and both of these have a multitude of suppliers available to them. Pipelines are long-term, expensive, fixed and often inflexible pieces of infrastructure and typically underpin baseload demand. LNG is often suited to more short-term gas demand needs. However, China has managed to develop a substantial volume of LNG import infrastructure such that, along with pipeline gas from Central Asia, LNG has become a baseload supply for the country. Similarly, in Europe, LNG can supplement supplies to countries with existing pipeline connections or provide gas to countries that have no connection to the pipeline grid.

Much depends on the growth of the gas market since that will determine the intensity of competition between different energy forms and between suppliers. China’s demand for both energy and gas is set to rise in the medium-term, Europe’s is much less certain as energy efficiency and the energy transition take a more important place in the continent’s energy outlook. With Russia delivering both pipeline gas and potentially LNG to Europe, managing the market will be important – although the scale of the pipeline business dwarfs the potential LNG volumes. Similarly, with China, although here the LNG is likely to focus more on the markets of southern China while the Power of Siberia (and potentially a second line) are more suited to supplying China’s northeast provinces.