Oil prices have been in the news again – mainly because the OPEC+ Joint Ministerial Monitoring Committee (JMMC) met yesterday to decide what to do with the cartel’s output. Ignore the headlines that they’ve opened the taps and prices are only going one way – down. So far, from what I can see, there’s nothing unexpected about their decisions.

The cartel agreed at its previous JMMC meeting to cuts in output of 9.7 mbd for May and June and then 9.6 mbd in July as Mexico ends its cut. From August onwards the plan has always been to increase output by 2 mbd (meaning the cuts themselves are reduced to 7.7 mbd). That’s what seems to have been agreed so, on the face of it, there’s nothing to be alarmed by.

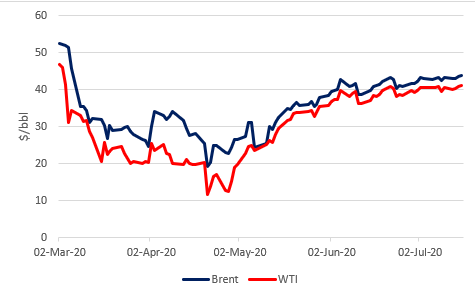

The good news is that the market has taken this in its stride – prices are marginally stronger by about $0.20/bbl and now seem to have settled in the $40-45/bbl range. Oil prices at this level are just about acceptable for Russia, with its breakeven price at around $42/bbl. However, for most of OPEC, these prices are far below the level they need to balance their budgets (Saudi needs $73/bbl and Iran $125/bbl).

Oil prices March to date

How do they get from $40-45/bbl to $70-75/bbl? As I see it, there are two ways. The first is strong and effective compliance on production and the second is the recovery from Covid-19 and higher underlying demand.

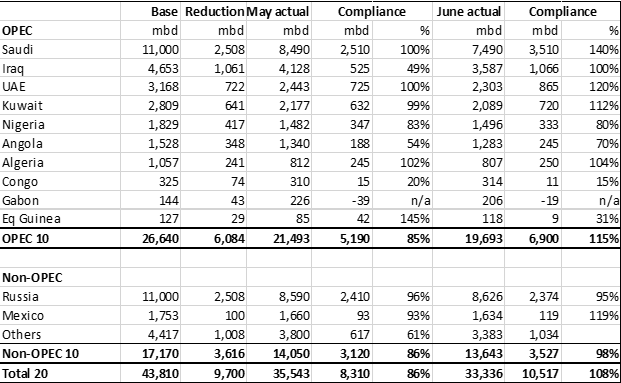

Compliance

Compliance has been extremely good, contrary to the usual behaviour of cartel members in past crises – the short-lived Saudi-Russia price war clearly concentrated minds. The main OPEC producers exceeded their planned cuts with overall compliance of 115% in June. A lot of this was due to Saudi Arabia – whose compliance was 140% – because Riyadh has maintained its extra 1 mbd cut into July (although this will likely end by the beginning of August). Non-OPEC was slightly less good at 98% (with Russia being a notable laggard at just 95% after 96% in May) but overall compliance for OPEC+ was a very strong 108%.

If OPEC+ can maintain this level of compliance – and remember it’s artificially boosted by Saudi Arabia’s additional 1 mbd cut which is shortly to end – then that’s a good start for the second half of the year. But it’s also a big IF…

In the past compliance has been the major constraint, certainly on OPEC, when faced with oversupplied markets. However, the current crisis appears to have encouraged more solidarity – how long that lasts nobody can predict.

June OPEC+ Compliance

Outlook for demand

The latest IEA data makes for sobering reading. Now that we have actual data for 2Q20, we can see that the demand decline of 16.4 mbd in the quarter was without precedent. The low point of 77 mbd was clearly in April and overall demand had risen by around 10 mbd by June (still 10 mbd below its historic range). From a peak of more than 5 million people under lockdown in late March, that total had fallen to under 2 million by the end of June.

The IEA is moderately optimistic about the course of future demand, predicting that 2020 will show demand of 92 mbd, 8% lower than 2019. Demand in the second half of the year, where OPEC+ are now looking, is forecast to rise by 8% compared to the first half. 2021 is expected to show an increase of 5.3 mbd (6%) over 2020’s outturn.

While that may sound moderately supportive of the OPEC+ efforts to increase prices as we go into the second half of the year, we should bear in mind that these are only forecasts and are subject to many factors outside anyone’s control. The latest lockdowns in places as diverse as Hong Kong, Melbourne, Portugal and many parts of Africa, as well as the renewed struggles in several US states, suggest that the virus is not sufficiently under control that we can be entirely confident about these demand forecasts.

Outlook for supply

The IEA estimates that oil producers shut in around 14 mbd of output through the second quarter. They expect supply to increase in the third quarter as producers respond to a better operating environment. Overall output in June was 13.4 mbd lower than a year ago, mainly because of the OPEC+ output cuts which brought OPEC output to its lowest level for thirty years.

From a cut of 9.7 mbd in June, OPEC+ output cuts fall slightly to 9.6 mbd in June as Mexico exits the agreement and then to 7.7 mbd in August before reaching 5.8 mbd from the start of 2021. The IEA calculates that if these cuts are made with full compliance, overall 2020 output will decline by 7.1 mbd but recover by 1.7 mbd in 2021.

Stocks

Stock data comes out somewhat later than production and consumption data, but what is currently available shows a large commercial stockbuild in May after a rise in April. At the end of May, stocks were some 9% higher than the five-year average. Early data for June suggest that stocks have grown rather than declined as they typically do in this month.

May also saw record levels of oil in floating storage but with the contango weakening and a tighter second half anticipated some of these volumes have been sold.

Supply/demand balance

With supply expected to fall by 7 mbd this year and demand to fall by around 8 mbd overall, the outlook remains clouded by uncertainty because the supply number hinges crucially on OPEC+ compliance while the demand number is also subject to quite a lot of uncertainty because of the localised resurgence of the coronavirus.

It’s a game of two halves as I believe some people say and the market is now expecting a tighter market in the second half compared to the very oversupplied market that we saw in the first half given the output cuts by OPEC+ and the recovery in demand so far.

Looking into 2021, the picture is perhaps more encouraging. The IEA forecasts demand to rise by 5.3 mbd next year while supply should increase by just 1.7 mbd if OPEC+ sticks to its quotas. Together that should suggest a tighter market in 2021 even allowing for Covid uncertainty as regards demand. 2021 may also be a year with upside if either vaccine or successful therapeutics emerge and enable some form of return to normality.

Price outlook

Given the good discipline seen in the OPEC+ cartel and the evidence of rising demand in the second quarter, it would be foolish to bet against a continuing oil price recovery through the second half of the year. The risks though are to the downside – partly coronavirus-related because of a rising number of cases in some countries and partly that both OPEC+ compliance and US shale are threats to the supply side of the equation. Oil at $40+/bbl has not reached a level which can finance most producers activities and most governments’ revenue needs, however oil at $40+/bbl has already allowed US shale producers to add 1 mbd of output in the post-crash environment, although whether too much more will be added by producers looking to maximise profit rather than production is one of the key questions.

On balance, I would say prices will drift higher in the absence of any major resurgence of the coronavirus or a breakdown in OPEC+ compliance. The upside ought to be capped by the possibility of higher prices encouraging additional US shale output, although the financial challenges faced by the sector may well ensure the shale companies remain focused on profits rather than production and allow more price upside than would otherwise have been the case.