The collapse in global oil demand looks set to continue into 2021 according to the International Energy Agency’s latest analysis. They conclude that demand won’t rise above the 2019 level of 99.8 mbd before 2022 or even 2023 depending on the path the coronavirus takes. If there is a second wave – as many fear – which leads to further lockdowns and dislocations globally, then economic growth will probably not be sufficient to drive oil demand beyond 100 mbd in 2022 and we will have to wait until 2023 to see positive growth against the 2019 level.

Peak Oil – before or after?

That said, we discussed in late May the idea that ‘Peak Oil’ demand may actually be behind us and that we may look back in a few years and see 2019 as the year the world crested the peak of oil demand and since then had been on the downslope. I highlighted that there were two schools of thought: those that believed that we were indeed now already beyond peak oil and those that thought that point was still to come, based on a predicted recovery in demand in the transport and petrochemical sectors.

IEA data suggests we may be past Peak Oil

My view then was that the latter group were overly optimistic (or talking their own book?) and yesterday’s IEA data gives them little comfort. The agency is forecasting an unheard of 8.1 mbd decline in 2020 followed by a relatively substantial 5.7 mbd increase in oil demand in 2021. While economic activity will be recovering to more normal levels as lockdowns ease, 2021 oil demand will still be 2.4 mbd below that of 2019. Transport demand – which is by no means recovering in the way its boosters hoped – will continue to be under pressure. Aviation fuel demand is predicted to be lower than a year ago in every month until February 2021, while only next February is gasoline and diesel demand growth forecast to turn positive against the previous year.

Aviation likely to be hardest hit

Aviation is singled out by the IEA as the industry likely to take the longest to recover and where the path of recovery is most uncertain. Not only does demand recovery depend on economic growth, it also depends on government decisions on opening airspace to create air corridors between ‘safe’ countries as well as on consumers’ willingness to undertake the ‘risky’ activities of going on holiday and on business trips (and I’m writing this from a city which effectively closed its borders on March 19th and will not reopen them until September 18th at the earliest, with only residents allowed to enter and then only after a 14-day quarantine).

There has been an increase in the number of flights around the world, although in most cases from very low levels, with a particular focus on domestic flights because of the closure of many international borders. The IEA notes that, despite the reopenings that have taken place, the demand for air travel is more than 70% lower than it was in 2019. The summer holiday season will soon be underway in Europe and North America, which ought to stimulate some demand and the IEA forecast a 57% increase in aviation fuel demand in 3Q against 2Q, when lockdowns were widespread, with a focus on domestic flights and on regional, rather than long-haul, flights. This combination of flight restrictions, nervous flyers and a challenged economic environment are likely to mean that jet fuel demand will still be 25% below 2019’s level in 2021.

Lockdowns easing, cases rising

Lockdowns themselves are being eased, particularly in Europe and in the US. However, localised clusters of cases continue to appear even though the trend in these regions is broadly downwards – particularly as economic and social activity picks up after the lockdowns. There has been a renewed outbreak in Beijing, highlighting how difficult it is to eradicate the virus from an area, and cases still appear to be growing in Africa and the Middle East. Political eaders, or their families, in the UK, Canada, Australia, Russia, Ukraine, Honduras and Burundi have all been infected, which is unlikely to do much to encourage their citizens to embark on extensive travel as soon as the restrictions are eased.

Supply side looking better after last OPEC+ meeting

Oil supply has been declining at a fairly rapid pace. The IEA calculates May production was down by 11.8 mbd against April, June is likely to be down by a further 2.4 mbd and overall 2020 output will be down on average by 7.2 mbd. However, they expect – at this stage at least – that 2021 output will rise by 1.7 mbd as conditions improve. That’s a lot less than the forecast increase in 2021 demand of 5.7 mbd so the outlook for 2021 is certainly better than that for 2020 as far as oil markets are concerned.

The April OPEC+ agreement led to a pledge to cut output by 9.7 mbd with additional volumes from non-OPEC producers such as the US where lower prices would inevitably choke off supply (and that certainly seems to be happening). Compliance with that agreement in May was relatively good, at around 86%, although there were clearly outliers. In June OPEC+ agreed to extend the June cut of 9.7 mbd into July, which meant that the July cut was 2 mbd greater than originally planned. But the Saudis are ending the extra 1 mbd cut that they made in June so that will reduce the overall impact in July from a 2 mbd larger cut to a 0.9 mbd actual reduction (subject, of course, to compliance with the cuts agreed) and we know from experience that gets harder as time passes.

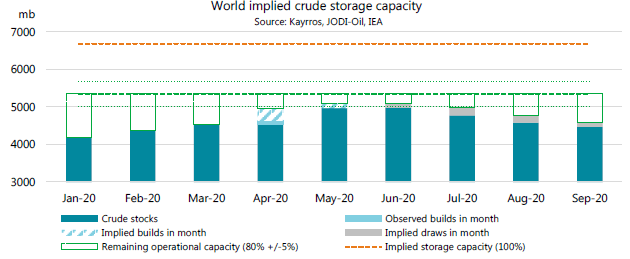

Stock levels will likely start to fall from late June the IEA suggests as the OPEC+ production cuts continue to reduce supply and as the reopening of economies prompts greater product demand and therefore demand for crude by refineries. The IEA calculated that capacity utilisation at the end of May was 76% and that the production cuts and demand increases have prevented storage overflowing – as was the concern a couple of months ago. Their chart below shows forecast stock levels moving away from the danger zone of 80% capacity utilisation.

Oil prices gently rising, but concerns remain

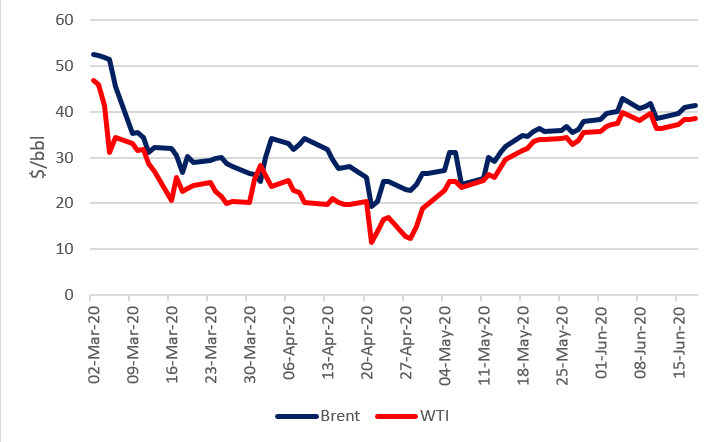

With the recovery in demand and the impact of the production cuts, oil prices have been gently rising over the past couple of weeks. However, prices have stalled in the last day or so after the rise because of ongoing concerns about a second wave of coronavirus – especially with events in Beijing – and the impact this would have on oil demand if further lockdowns are needed.

With Brent around the $40/bbl level, the drivers of change from here are new lockdowns being introduced and a resurgence in US shale output – both of which would be negative; and an upside surprise on compliance from the OPEC+ cartel when we see the June numbers in a couple of weeks’ time – which would be positive.

Oil prices, March to date

A fuller archive of my blogs is also available at:

https://blogs.tslombard.com/tag/stephen-osullivan

I can also be reached on Twitter: @osullivanenergy