We said last week that lower oil prices were inevitable. We based that assessment on the ongoing mismatch between collapsing demand (forecast to have fallen by between 25-30 mbd) and supply cuts (of just 9.7 mbd) which have not even been implemented yet. The OPEC+ agreement falls short of what needed to be done and its effective implementation is questionable based on past experience.

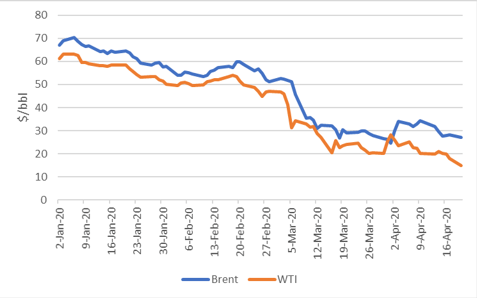

Then the Brent price was $31.74/bbl. Today it is 14% lower at $27.02/bbl. WTI – the main US domestic grade – fell by more than 20% in Asian trade to $14.49/bbl, levels not seen for more than 20 years. The pressure is still on the oil market to demonstrate that it is capable of responding successfully to the extraordinary event of the Covid-19 pandemic and the demand destruction that it has caused.

Brent oil prices year to date

The price action is complicated by the near-term expiry of the May WTI futures contract and the falls in later months and other grades have been less extreme, in the order of 3-5%. However, there are growing fears that June WTI could face the same fate as that contract approaches expiry, fears driven by the approaching shortage of storage capacity as it steadily fills from the excess supply of crude over the next few weeks.

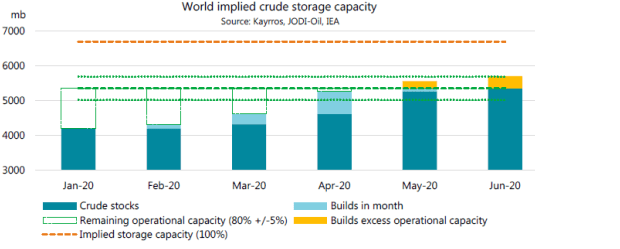

My colleague Christopher Granville noted over the weekend that the IEA’s latest monthly Oil Market Report had concluded that global crude storage capacity was facing an implied stock build of 12 mbd in the first half of 2020 and that a build of this magnitude could quickly overwhelm the oil industry’s logistics infrastructure – ships, pipelines and tanks.

The chart below illustrates the challenge. The IEA estimates that at the end of January there were 4.2 bn bbls of oil in storage, which itself had capacity of 6.7 bn bbls – suggesting that storage was 63% utilized. Our colleague Konstantinos Venetis, who also follows oil markets, estimates that storage is now closer to being 75-80% utilized, using as compelling evidence the contango in the forward curve. With the IEA highlighting 80% +/-5% as the remaining operational capacity, we can see that probably by May and certainly by June there will be insufficient capacity in the world’s crude storage facilities.

There is flexibility in the use of tankers as floating storage, certainly if oil production declines, and the IEA estimates that this could add 3-5% of capacity (some 220-330 mn bbls). We have already seen this process starting to happen and as stocks approach their operational limits, flexibility starts to disappear and optimization becomes impossible with sub-optimal fill-rates into storage dictating production rates at the far end, crude and products of different types unable to be mixed and storage topping out in land-locked regions ahead of more accessible ports and terminals.

What would happen to prices if storage did reach capacity? Well, they would probably fall further. Indeed, there has been discussion in the oil market about negative oil prices, arising when producers pay buyers to take oil off their hands because the alternative is to shut-in production. In some cases that could be severely damaging for reservoirs – in Russia for example but also where the crude contains a high proportion of wax and, when not moving along a pipeline, has the tendency to create what resembles a very large wax candle. Oil producers may well seek to get crude out of their systems at almost any price just to ensure continued production and avoid these serious operational issues. However, with lockdowns still in place over most of the world, lower – or even negative – prices are unlikely to stimulate demand that much, consumers simply cannot, or will not, travel at the moment so low prices could have only a very limited impact on demand and therefore do little to solve a looming storage crisis.

With storage approaching capacity, will there be another OPEC+ meeting? Potentially yes – if the situation continues. It may not be the grand affair of the last meeting in Vienna, but certainly discussions – almost certainly already taking place at the technical level – will be given a renewed impetus with a focus on effective compliance and monitoring to ensure that the agreement is adhered to (however flawed that agreement– the baseline from which cuts are calculated is an out-of-date October 2018 and we should not expect another 10 mbd of cuts from non-OPEC countries, certainly not voluntarily).

Will that be enough to stave off a further crisis? Watch this space, we are literally in uncharted territory in the oil market these days.